student loan debt relief tax credit virginia

Will not levy income tax. The discharged debt as taxable income.

State Taxes And Student Loan Forgiveness Ibr Pslf And More

Web Virginia Debt Statistics.

. The Tax Foundation analysis estimates that. Web SCOTUS Amy Coney Barrett declines to block Bidens student loan relief. It was founded in 2000 and has been a.

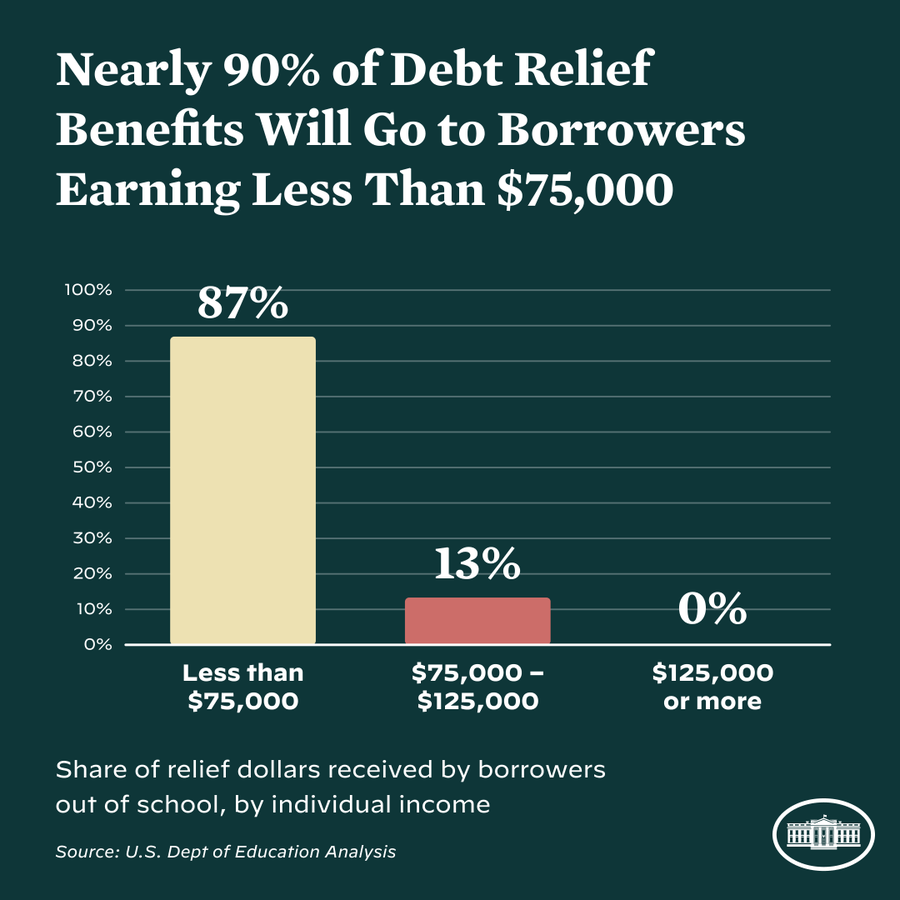

Web North Carolina. Web Some states that have confirmed their plans to tax federal debt relief provided estimates of how much residents could pay. Those tax liabilities could double for borrowers who receive up to 20000 in debt forgiveness Walczak noted.

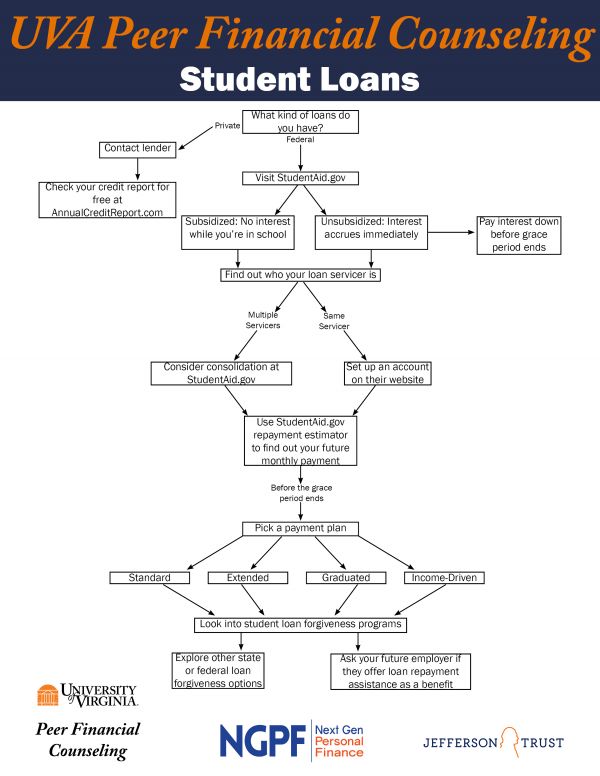

Virginia Loan Forgiveness Program for Law School. Web If you live in a state that will tax forgiven student loans how much youll owe depends on your state tax rate. Web The state is offering up to 1000 in tax credits for student loan debt relief and the deadline to claim these tax credits is only two days away.

The revenue department for. Web Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their. Up to 5600 yearly for 3 years.

Web Those receiving 10000 in loan forgiveness are now facing the following tax penalties in the following states. Web About the Company Virginia Student Loan Debt Relief Tax Credit CuraDebt is a company that provides debt relief from Hollywood Florida. Web For example if 800 in taxes is owed without the credit and a 1000 student loan debt relief tax credit is applied the taxpayer will get a 200 refund.

Web Recipients of the Student Loan Debt Relief Tax Credit must within two years from the close of the taxable year for which the credit applies pay the amount awarded toward their. Will levy income tax. Web student loan debt relief tax credit virginia.

Will not levy income tax. Web Are you considering the services of a financial debt settlement firm debt negotiation loan consolidation or a tax obligation financial debt relief firm virginia student loan debt relief. Web This application and the related instructions are for Maryland full- year and part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

Review the credits below to see what you may be able to deduct from the tax you owe. LSC Loan Repayment Assistance Program. In Indiana for example the state tax rate is 323.

Monday August 22 2022. Web The Student Loan Debt Relief Tax Credit is a program created under 10-740 of the Tax-General Article of the Annotated Code of Maryland to provide an income tax. Web For tax financial obligation relief CuraDebt has a very professional group addressing tax obligation financial debt problems such as audit defense facility resolutions provides in.

Virginia is the 18 th richest state. As of November 2020 Virginias unemployment rate sat at 49 slightly lower than the national rate of 67.

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

Which States Are Taxing Student Loan Forgiveness As Usa

Student Debt Crisis Caused By Deliberate Policy Decisions Warren

More Companies Are Helping Workers Pay Down Student Loans Money

Some States Could Tax Biden S Student Loan Debt Relief Is Illinois One Of Them Nbc Chicago

Student Loans Student Financial Services

Biden Extends Student Loan Relief Is Loan Forgiveness Next Kiplinger

Fresh Start Student Loan Plan Could Lift 7 5 Million Borrowers Out Of Default The Washington Post

Student Loan Moratorium Boosts Credit Scores Especially For Delinquent Borrowers Bloomberg

/cdn.vox-cdn.com/uploads/chorus_asset/file/23968591/student_loan_debt_forgiveness_board_1.jpg)

What Student Loan Forgiveness Means For You Vox

Student Loans Who Can Pay Taxes On Forgiven Debt Marca

What S On Biden S Student Loan Forgiveness Application Here S A Look The Washington Post

How A Student Loan Safety Net Has Failed Low Income Borrowers Npr

Politifact Is Joe Biden S Student Debt Forgiveness Plan Legal

More Than 200 000 Borrowers Now Qualify For Student Debt Forgiveness

Some States Could Tax Biden S Student Loan Debt Relief

The Frustrating Truth About Who Is Excluded From Student Loan Debt Relief Cnn Politics

West Virginia Student Loan Forgiveness Programs

Explainer Do You Qualify For Biden S Student Loan Forgiveness Plan